GAR - Detailed Workflow Guide

Garnishments & Levies - Detailed Workflow Guide

The following is a generic guide of issues, tips, and common practices for the garnishment workflow in Safari.

REMEMBER to check the Library in Safari for your company's specific version of this workflow guide or other policy instructions.

TERMINOLOGY

- "Customer" is a generic reference to the debtor in a garnishment. For example, the customer/debtor could be a depositor of the FI or a vendor of a retailer that holds funds for the vendor. Credit Unions typically refer to their depositors as “members,” but for simplicity this help page refers to all depositors as “customers.”

- "FI" means financial institution, which is also the garnishee.

- "Garnishee" means the company that holds funds of the customer/debtor. It is typically an FI or a retailer that holds funds of vendors.

- "Garnishment" is a legal process by which a judgment creditor seeks to seize the assets of a judgment debtor held by a third party (sometimes called the garnishee). There can be many names for this general process, including a garnishment, writ of attachment, execution, levy, seizure order, forfeiture, or other similar legal process or order. For simplicity this help page refers to all of them as a garnishment.

- "Issuing Authority" means the court, agency, or other authority that issues the legal order. Often the Issuing Authority is different than the "Serving Party," although they can also be the same. Safari allows you to track both the Issuing Authority and the Serving Party or indicate if they are the same.

THIS WORKFLOW GUIDE IS NOT LEGAL ADVICE

This Guide is not legal advice and should not be relied on to be legal advice. Each company on Safari is solely responsible for determining the applicability and interpretation of cases, laws, statutes, and regulations as applied to its business and its use of Safari. Safari is intended for use by customers with professional skill and knowledge of relevant legal requirements and each customer is solely responsible to obtain legal advice as necessary.

1. Garnishment served on garnishee/FI

1.1 Government Levies - Automated Intake

Safari now has multiple ways to receive an automated feed from government agencies:

- A "ServePort Exchange," which is typically an SFTP site for receiving levies in the X9.129 format or spreadsheets. Safari extracts all the levy data and puts it in the matter fields in Safari, and generates a human-readable version of the levy for viewing in the 'Served' folder.

- The ServePort Agency Portal, which allows "registered" agencies to serve levies and legal orders in the form of PDF documents. If an agency is not registered, they cannot use the portal (contact your Safari Customer Success Manager for more information or to request that an agency become registered). Safari will only allow a state agency to serve a financial institution if it has authorized service in the agency's state (there are no limits on federal agencies). Safari uses Microsoft Azure AI to extract the key levy data from the PDF, and automatically creates a matter with all the data populated in fields.

Even if you receive paper levies from an agency, if Safari has trained Levy Manager to recognize the levy, Safari will automatically extract the key levy data, using the same Microsoft Azure AI it uses with the ServePort Agency Portal.

1.2 Court Orders - ServePort

If an automated download from your registered agent or an Intake Email does not automatically input the account garnishment in Safari, then you'll need to create a matter manually in Safari, and upload a file copy of the account garnishment into the Served folder. To learn more about each of these options, see Add / Close Matters.

1.3 Automated Download from your Registered Agenct

If your financial institution has set up an automated feed from your registered agent, Safari will automatically download the levy or court order and create a matter. If it does not recognize the form, Safari will OCR the document, meaning that you will be able to copy and paste text from the document into the matter fields.

1.4 Manually Inputting served documents into Safari

If one of the methods above does not create the matter, then you'll need to create a matter manually in Safari, and upload a file copy of the garnishment into the Served folder.

2. Legal analysis

2.1 Does the Issuing Authority have jurisdiction over the garnishee/FI?

Issue: The general rule is that an Issuing Authority won't have jurisdiction over an Entity that doesn't do business in the state of the Issuing Authority. One exception is for federal agencies, and possibly state agencies in certain circumstances.SERVICE BY STATE AGENCIES AUTOMATICALLY LIMITED. Note that the ServePort Agency Portal is configured to allow state government agencies to serve only those financial institutions that have authorized service of process in that state. See ServePort Agency Portal for more information.Safari Configurable Warning: You can configure Safari to provide a warning when this situation exists (but to be clear, Safari doesn't specify how to resolve this situation, which you must determine by your company's policy). If a warning triggers, a Compliance section appears on the left side of the Matter. To resolve the warning, enter an explanation in the resolution field. See Workflow - Alerts and Warnings to learn more.REMEMBER TO CHECK THE LIBRARY IN SAFARI for your company's specific policy for resolving this type of warning.

2.2 Does the Issuing Authority have jurisdiction over the assets?

Issue: State law varies significantly on this issue and makes the processing of an out-of-state garnishment complex. One approach is to think of an out-of-state garnishment as not being domesticated (i.e., when the garnishee/FI is served in a state that is different than the Issuing Authority). The judgment creditor can easily domesticate a garnishment order by first domesticating it (or the judgment) in the state in which they want to serve an account garnishment. Some companies have a policy of rejecting account garnishments that have not been domesticated.Safari Configurable Warning: You can configure Safari to provide a warning when this situation exists (but to be clear, Safari does not specify how to resolve this situation, which you must determine by your company's policy). If a warning triggers, a Compliance section appears on the left side of the Matter. To resolve the warning, enter an explanation in the resolution field. See Workflow - Alerts and Warnings to learn more.REMEMBER TO CHECK THE LIBRARY IN SAFARI for your company's specific policy for resolving this type of warning.

2.3 What state law applies?

Issue: The rules for exemptions, answer due dates, processing fee limitations, etc. vary depending on which state's laws apply. Determining the applicate state law can be a complicated legal question that may depend on several factors, including the location of the Issuing Authority, the debtor/customer's residence, and/or the location of the account.

Safari Configurable Warning: You can configure Safari to provide a warning when a multi-jurisdiction situation exists (but to be clear, Safari does not specify how to resolve this situation, which you must determine by your company's policy). If a warning triggers, a Compliance section appears on the left side of the Matter. To resolve the warning, enter an explanation in the resolution field. See Workflow - Alerts and Warnings to learn more.REMEMBER TO CHECK THE LIBRARY IN SAFARI for your company's specific policy for resolving this type of warning.

3. Customer and Account Identification

3.1 Is the debtor a customer?

AUTOMATION WITH API INTEGRATION. Safari API integration automates the search for a customer using the taxpayer ID, first and last name, or entity name. See Setup - API Integrations for more information.

The first step involves conducting a search to determine whether the debtor identified in the garnishment is a customer.

3.2 Does the debtor/customer have an open account?

AUTOMATION WITH API INTEGRATION. Upon identifying a customer, Safari automatically retrieves account information, account balances, and relevant ACH transactions (usually 60 days) to identify possible exempt funds. This streamlined process ensures that all relevant financial data is efficiently collected and available for users to determine the proper amount to seize. See Setup - API Integrations for more information.

The garnishee/FI processor determines this by accessing the core system records. This is completed manually and cannot be automated in Safari. If the debtor is not a customer or has no funds, after notifying the applicable parties, that matter should be closed with a status of "Closed No Account/Debtor" or "Closed

No Funds."

4. Funds seized & Excemptions

4.1 Point-in-Time vs Continuous Garnishments

A "point-in-time" levy requires the financial institution to check for available funds only at the moment the levy is received. The institution must seize the funds present in the account at that specific time.In contrast, a continuous levy involves a more ongoing process. After receiving the levy, the institution must freeze the customer’s account and, on the payout day, send any available funds to satisfy the levy, regardless of fluctuations in the account balance in the interim. This makes continuous levies more complex and requires ongoing monitoring to ensure compliance. Safari will be providing specific functionality for continuous levies beginning in April 2025. Please check back then for more information.

4.2 Point-in-Time - What funds were available when the order was processed?

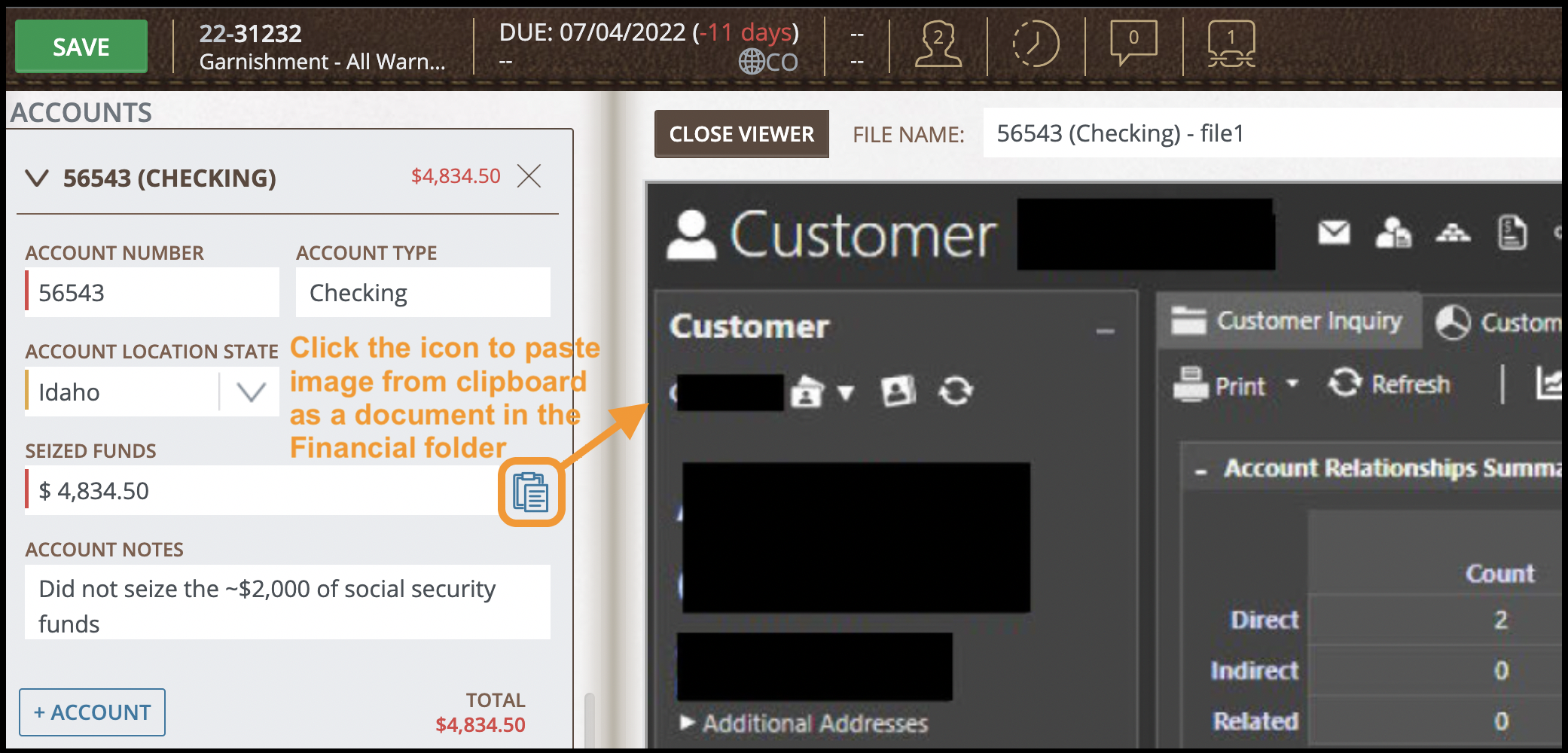

AUTOMATION WITH API INTEGRATION. If you have enabled an API Integration of accounts records, the audit history for the account balance at the time of receiving the levy is automatically captured. See Setup - API Integrations for more information.If your financial institution has not enabled API Integration, most will save screenshots of the customer's account to show funds available at the time the order was received. This gives your company liability protection if there was later a dispute about what funds existed at the time the garnishee received the legal order.SAFARI TIPSafari has built a special upload tool to help you upload one or more screenshots into Safari more quickly:

- Click the +ACCOUNT button to create an account record, and enter the account number.

- Copy a screenshot of the customer's account to your clipboard.

- Click the paste image icon to the right of the Seized Funds field (see image below)

- The image uploads as a file in the Financial folder, with the file name profiled with the account number.

- Click SAVE to upload the file into Safari.

4.3 Is the garnishee/FI required to apply exemptions, or merely notify the debtor/customer that they can seek exemptions?

If exemptions are enabled for the selected Subtype of a matter, users must complete key exemption-related fields, including

- State Law Applied

- State Exemption Amount, if applicable

- Federal Exemption Amount, and

- Notes about what exemption(s) were applied.

In some states, the debtor has to request an exemption. In those cases, your company should have configured the system so that the State Exemption Amount field is optional, so it can be left blank if no exemption is requested.In other states, the garnishee/financial institution is required to identify and apply the exemption. For those, your company should have configured the State Exemption Amount field to be required.

REMEMBER TO CHECK THE LIBRARY IN SAFARI for your company's specific policy for resolving this type of warning.

EXEMPTION SETUP OPTIONS: For detailed setup instructions on how exemption fields can be configured, refer to the 'Garnishment Compliance Guide' on the Setup - Compliance Policies help page.

4.4 Point-in-Time - Seize funds that are legally required to be seized.

AUTOMATION WITH API INTEGRATION. Safari can automate seizing or releasing funds, freezing and unfreezing accounts, and charging a Processing Fee (if appropriate). See Setup - API Integrations for more information.

Whatever your company's method of seizing funds, you should record the amount in the Seized Funds field associated with the account. If any funds are not seized because of federal or state exemptions, document that in the Account Notes field.

5. Answers to interrogatories / other notices

5.1 Answers for government agency levies and legal orders

Safari has created specific auto-answer functionality to streamline the generation and delivery of auto-answers to state agencies. See Levies - Auto-Answer to State Agencies for more information.

5.2 Answers to interrogatories in court orders (e.g., providing information on assets).

Sometimes it's easiest to fill out the forms by hand, mail them, and upload a copy in the Answer folder. If the form is set by statute and has some flexibility in format, consider creating a template to automate the generation of an answer.

5.3 Other notice to the debtor/customer may also be required (legally or by your company's policy).

Laws or regulations may require a notice be sent to the customer/debtor. Typically those are physically mailed. Consider creating a template to automate the generation of these notices.

6. Full/partial releases

6.1 When the creditor partially or fully releases the lien, the garnishee/FI needs to document the release and then track the remaining amount of seized funds to be paid (if any).

When you receive a full or partial release from the garnishor, do the following:

- Click the RELEASE TO DEBTOR button to the right of the Judgment / Lien Amount field.

- Enter the Release Amount, the Release Date, and any Release Notes.

- Upload a copy of the Release in the Served folder.

- Update the seized funds amounts in the accounts section reflecting how much is currently frozen (the update reflects that the released funds have been unfrozen for the customer).

- Click SAVE .

- Once you click SAVE, Safari will dynamically update the Pending Amount field (see Acct.Gar.-Financial-Related Data).

7. Payment to creditor / garnishor

7.1 Some states specify a fixed number of days for the payment.

Some states specify a fixed number of days for payment. You should enter the date for this payment in the Date Due (Payment) field when you create the Matter. When you change the status for the Matter to be To Do Payment, then this date appears in the header for the Matter and on the Matter Listing page.

7.2 Other states require the garnishee/FI to wait for a court order before making the payment.

Some states don't specify a fixed number of days for the payment, and instead require the garnishee/FI to wait until it receives a court order. In this situation, do not enter a date in the Date Due (Payment) field, and instead change the status of the Matter to On Hold Court Action.

7.3 Pay the garnishor.

You can store the Payee information in the Creditor / Payee section on the left side of the Matter. To record a payment, do the following:

- If you are paying funds from the actual customer account, click the payment icon to the right of the Seized Funds field. (See image below; note that you won't see this icon if your company has set up a default account in the company and Entity setup pages.) This automatically creates a payment entry recording the customer account and amount.

- Otherwise, click the +PAYMENT button in the Payments section on the left side. If you are paying from a GL Account, then your system Admin can create a default value for the account number that will prefill (see Setup - Companies, Entities, and Offices).

NOTE ABOUT DATA VALIDATION. When you create a payment record, Safari prefills the amount with the lesser of the Pending Amount or the Total Amount Seized. Safari won't allow you to make a payment entry that is greater than either of those values.

8. FI fees collected from garnishor and debtor/customer

AUTOMATION WITH API INTEGRATION. If you have enabled an API Integration for funds transfer, you can automate the payment of your processing fee charged to the customer. See Setup - API Integrations for more information.

8.1 Fees may be set or limited by state law.

1. Record the garnishor fees you've received in the Garnishor Fees field.2. Record any processing fee you charge your customer in the Processing Fee field. State law may limit that amount, and/or specify whether it can be charged first or after the payment to the garnishor. Consult your company's policies to determine what amount you can collect.

Note that Safari does not calculate these amounts and end users must determine and enter them.

Related Articles

GAR - Financial-Related Data

The Financials section in the left side of a Matter gives you information about the lien, releases, accounts, seized funds, and payments. This help page explains all of the fields and buttons in this section. For a list of garnishment terms, see ...GAR - Workflow Status & Dates

Workflow Status and Dates For all matter types, Safari organizes Status into three general phases: To Do, On Hold, and Closed. For matters with a Type of "Garnishment," these statuses are specially tailored to garnishment workflows. Within the To Do ...Workflow - Status / Date Due

Overview The status selection in each matter is a critical workflow feature. Below are several examples: Tracking action that needs to be completed. Each matter has a series of "To Do" statuses. You can use these to monitor progress and identify work ...Docs - Uploader and Collections Workflow

Overview Safari simplifies the workflow when gathering documents or categories of documents in response to subpoenas or document requests (called "collections"). The system initially stores documents in the Collections folder. Once there, you can ...Workflow - Notes

OVERVIEW VIDEO TUTORIAL - Notes (3 mins) Notes are a convenient workflow tool you can use in many situations. If you're the Reviewer, use notes to remind yourself of a detail, or something you need to do. Also use notes to communicate with other ...